Keeping yourself safe during this property tax re-assessment year

Staying Safe During Your Property Tax Reassessment Year

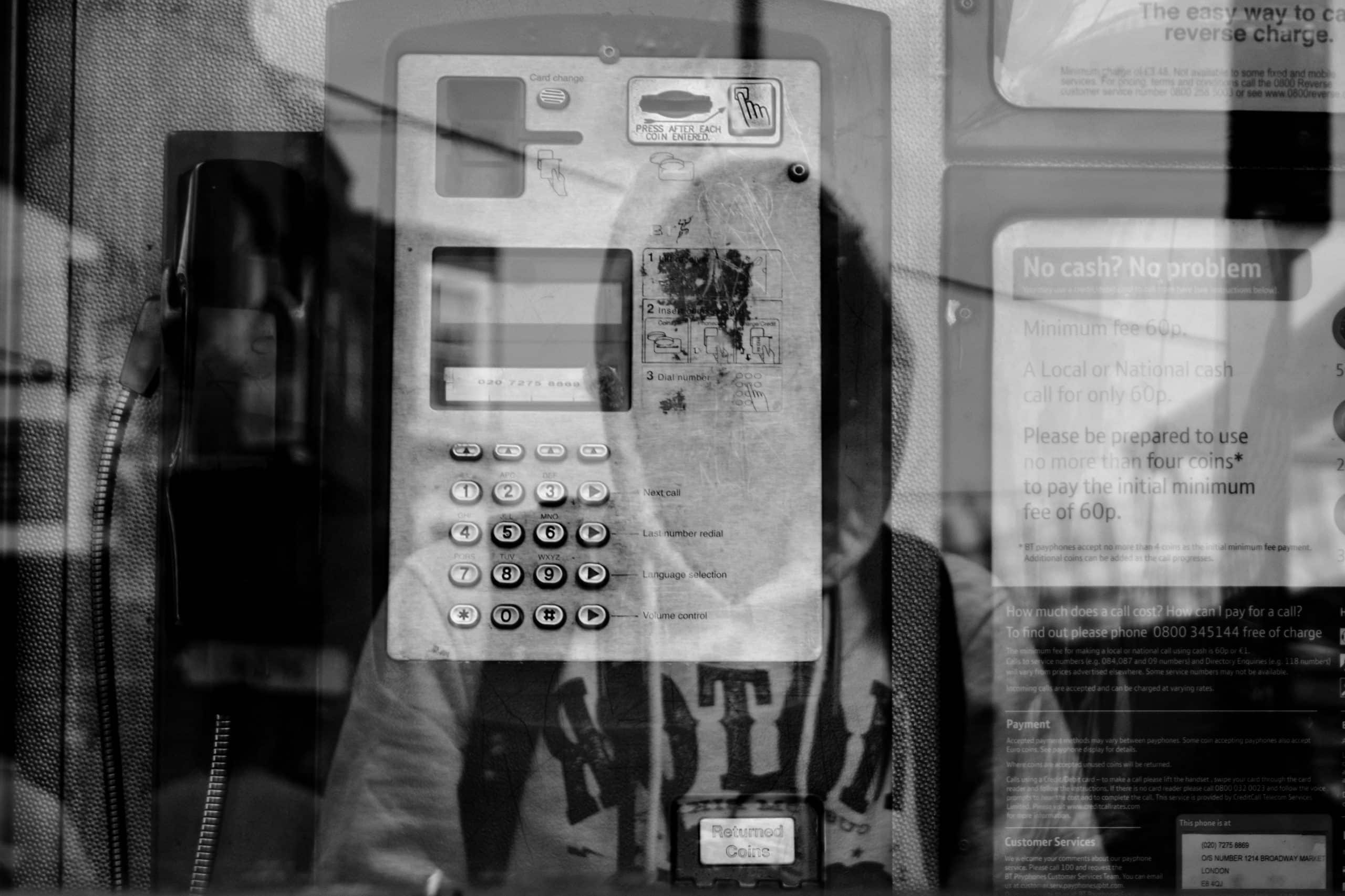

In recent years, more and more Americans have received scam phone calls from individuals claiming to be the IRS. These scammers usually threaten you with lawsuits, arrest, or even deportation. These scammers may mention that you have a warrant for your arrest or that your home is being monitored. Here are some things that you should know that come directly from the IRS:

1) The IRS does not call you to demand immediate payment using a specific payment option. Usually, the IRS will first mail you a bill if you owe any taxes.

2) The IRS does not threaten to immediately bring in local police or other law-enforcement groups to have you arrested for not paying.

3) The IRS does not demand that you pay taxes without giving you the opportunity to question or appeal the amount they say you owe.

4) The IRS does not ask for credit or debit card numbers over the phone.

Paying taxes, in one form or another, is part of everyday life, and questioning or appealing the taxes is an important step in that process. It’s unfortunate that these scammers try to take advantage of hardworking Americans. If you would like to read up more on this issue, feel free to visit the IRS website at: https://www.irs.gov/uac/tax-scams-consumer-alerts

Please contact the Law Office of Clyde Guilamo, LLC. to file your next property tax appeal.